New York Times columnist Peter Coy shared economists’ warnings that a U.S. recession “appears inevitable” in a piece published at the outlet Wednesday.

Coy noted that some experts believe the recession has already begun, telling him that if the economy is not already in recession, it will be by “the third quarter of this year.”

Macroeconomic researcher Julian Brigden mentioned to the author that the recession has been precipitated by the Federal Reserve’s “large and rapid interest rate increases,” claiming the bank has been “pile-driving this baby into the ground.”

Economic experts recently told the New York Times that if the U.S. economy isnt already in a recession then it is “likely” to be in one later this year. (Fox News)

Coy opened his column by relaying the overall reason for this “inevitable” recession, that people are borrowing less from banks at rates that haven’t been seen since some of America’s worst economic crises.

He provided the numbers, saying, “in the two weeks through March 29 of this year, the latest with available data from the Federal Reserve, loans and leases fell by $105 billion, or nearly 1 percent. That was the biggest two-week decline in dollar terms since the data series began in 1973 and the biggest in percentage terms since 2009, during the global financial crisis.”

The columnist provided two reasons for the dip in borrowing, one “bad” and one “worse.” He wrote, “The one you hear most is that there’s an emerging credit crunch: Banks are tightening their lending standards and turning people down for credit. That would be bad. The other possibility, though, which could be worse, is that the banks have money but people don’t want it.”

Coy noted that there is evidence that many people want to borrow, though have been finding it harder to get loans. He cited The Federal Reserve Bank of New York’s Survey of Consumer Expectations, which “found that the share of consumer respondents indicating that credit was harder to get than a year ago rose to 58.2 percent in March, the highest proportion recorded since the survey’s creation in 2013.”

The author noted this data point is somewhat hopeful, stating it still shows that people want to borrow. He wrote, “If you stop and think, though, a credit crunch, as bad as it is, at least indicates that there’s an appetite for borrowing that’s not being sated.”

TEXAS CITY USED FEDERAL COVID RELIEF FUNDS FOR ‘RACIAL EQUITY’ IN ‘AUDACIOUS’ AGENDA

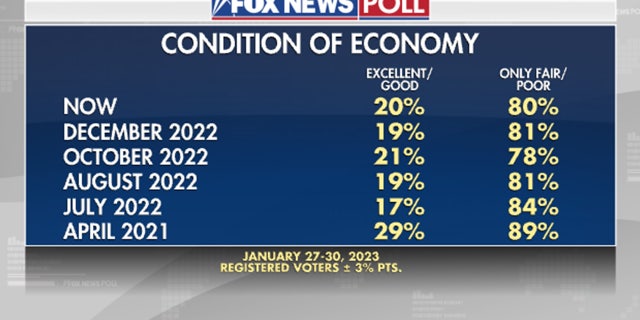

Condition of the economy through time Fox News Poll. (Fox News)

However, Coy said that at the same time there “are signs that the observable dip in loans and leases is at least partly due to weak demand,” and noted, “When you really have to start worrying is when people don’t want to borrow because they see bad times ahead. In that situation, monetary policy becomes less effective.”

The piece cited a survey indicating this demand slow down: “A New York Fed survey in February found that the application rate for any type of credit over the preceding 12 months declined to its lowest point since October 2020.”

Discounting the idea that this slowdown was due to fear of applications “being turned down,” Coy added, “the reported overall rejection rate for credit applicants decreased to 17.3 percent from 18.8 percent in October 2022, the bank said.”

He also pointed to the ominous figure that small businesses, which “rely on a lot of bank loans,” aren’t borrowing much either.

According to a March report from the National Federation of Independent Business, “Only 2 percent were planning an expansion, the least since March 2009.” Coy pointed out that at the same time “only 2 percent of owners reported in March that all their borrowing needs were not satisfied.”

The author quoted economic forecaster David Rosenberg, who looked at that data and observed, “That is a major ‘yikes!’”

Federal Reserve Chair Jerome Powell testifies during a U.S. House Oversight and Reform Select Subcommittee hearing on coronavirus crisis, on Capitol Hill in Washington, U.S., June 22, 2021. (Graeme Jennings/Pool via REUTERS)

Brigden, founder of Macro Intelligence 2 Partners, told Coy that the data shows “that a recession in the United States appears inevitable,” and that if it hasn’t already begun, it is “likely to fall into recession by the third quarter of this year.”

CLICK HERE TO GET THE FOX NEWS APP

Brigden added that the Fed’s interest rate increases “essentially preordained” this looming recession. He added that the bank is “pile-driving this baby into the ground.”